Data Room for Debt Sales

“The picture is perfectly clear: the entire economy is fueled not by profit, not by production, but by debt.” – Kirkpatrick Sale

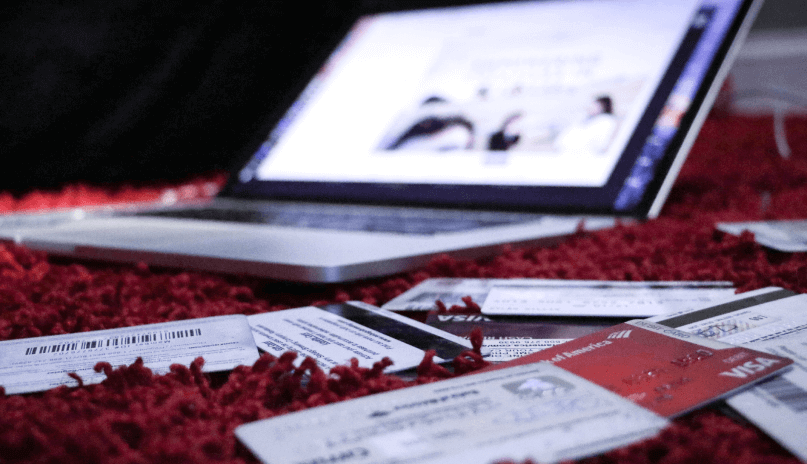

Handling sensitive data over the internet can be tricky and risky at the same time. One might consider free solutions available to them, but they’re far from being safe and always put your sensitive information at risk of exposure.

In this article, we’ll be looking at how data rooms can help you handle sensitive information like sales portfolios for debt sales whilst dealing with your prospective buyers.

What are debt sales?

In definition, a debt sale allows the company to sell off their accounts to a third party with a price based on a percentage of the outstanding balance, allowing the third party to retain 100% of the sold equity.

Debt sales help a lot when a firm is in severe distress. It essentially allows them to improve their recovery numbers while staying effective and losing as little asset as possible.

Suggestions for debt buyers and sellers

Not everyone starts on the same stage, and not everyone is guided properly. It is critical to be cautious that all legal requirements are fulfilled before proceeding to the stage of buying or selling your debts. This also includes selecting which party will be generally responsible for handling the debt and other duties.

However, the following are some suggestions that might be applicable when you’re preparing your sales portfolio for forwarding.

Keep track of all legal requirements

First and foremost, you’ll have to do a background check on the parties you’ll be dealing with for the debt collection or selling. Make sure to carry out the check on the party responsible for handling the transaction.

Always go through a formal channel whenever making large-sum deals. Prepare complete documentation of debt, buyer information, and seller information so that if in the future any complication arises, it can be traced back to the documentation.

Along with that, maintain a complete outline regarding the entire characteristics of the assets that are being sold or collected, and require a sign-off procedure to maintain the integrity of the deal.

Keep your portfolios safe

All the physical copies of your portfolio must be stored in a separate, private room, where only a select few officials are allowed to go.

Speaking of digital portfolios, to ensure your portfolio stays as secure as possible you’d have to invest in a firewall and a reliable anti-virus system. Couple that with strong encryption and password protection to ensure in-depth security.

Alternatively, you can go for a virtual data room solution that has all these security features built-in.

Keep your portfolio private

All the statistics present in your sales portfolio are crucial for the stable performance of your firm. There’s absolutely no reason to make information present in the portfolio open to public eyes.

However, in order to gain the trust of your audience, you might disclose the categories your portfolio houses. But not a pinch of information in those categories should be available for the public to see. Keeping this information as private as possible should be your utmost priority when it comes to the stability of your firm.

Keep the proposal information bare minimum

Whenever possible, properly evaluate your portfolio and highlight any sensitive information that you shouldn’t give out, then proceed to share the information regarding your sales portfolio with your prospective customer. There should be enough documentation readily available to the potential buyer to help them clearly understand different codes and statements in your shared sales portfolio.

Remember, always make sure to do an in-depth background check on your prospect first to make sure there’s no track record of them stealing data.

Transfer the data securely

When it comes to security, there is no compromise. You have to stay two steps ahead when considering the secure methods to send your sales portfolio to the other party.

The best way to transfer your sales portfolio safely would be to rely on the use of a virtual data room. It will allow you to securely arrange, share, and store your essential data, while keeping it protected from prying eyes. Most data rooms offer advanced protection mechanisms, such as two-factor authentication, end-to-end encryption, protection from viruses and malware, and more.

How data rooms can be useful for debt sales

Let’s overview some of the ways data rooms can be useful for managing debt sales:

- Set it up according to your prospects’ needs. One great thing about data rooms is that you can always customize them according to the prospects you’ll be presenting to. This includes selecting the vital information that can make the deal between the two parties. You can also categorize the documents precisely without making clutter, and choose who can access what in a few clicks.

- Keeps the potential buyers engaged. Most virtual data rooms can map your content precisely and present your potential buyer with notifications that can keep them engaged in your data room. Furthermore, you can also handle all requests from prospects in real time.

- Make regular audits effortlessly. With a VDR there is no need to go back and revisit every detail regarding your sales portfolio. You’ll be ready for audits every time. Your data room can generate an automatic paper trail that you can present at the time of audit.

- Share documents securely. All the information that flows back and forth between the two parties is carried out within secure channels, such that all the traffic is encrypted and only authorized persons are allowed to access sensitive files. This way your debt sales record is transferred securely without any fear of corruption or loss.

Using VDRs for debt sales

Using a virtual data room is great for your debt sales record and sales portfolio, just because a data room makes handling sensitive data hassle- and risk-free. If you’re on the lookout for the optimal virtual data room solution, consider using Ideals. It is one of the leading VDR providers on the market, offering a bulk of security features — from two-factor authentication to encryption, fence view, watermarking and more.

If you’re uncertain as to where to get started, the checklist below is exactly what you need to start testing, using, and maximizing your business efficiency with a VDR.

- Get your desired VDR package. They all vary in terms of storage options and bandwidth usage. Find the one that suits your needs and opt for the 30-day trial period.

- Prepare file infrastructure beforehand. Perform all the necessary file checks before preparing your virtual data room for debt sales. This includes naming them properly and devising a file structure scheme with your team.

- Prepare files in the data room. Proceed to upload the files to your data room and name structure the directory scheme precisely as you planned. You can share the naming scheme with your prospect as well, to further their understanding.

- Manage user access. Set up privileges and user accessibility in such a way that only your authorized personnel, and the authorized personnel of your client, can access it. You can also limit the view ability of your documents by allowing watermarks and restricting the ability to print or download.